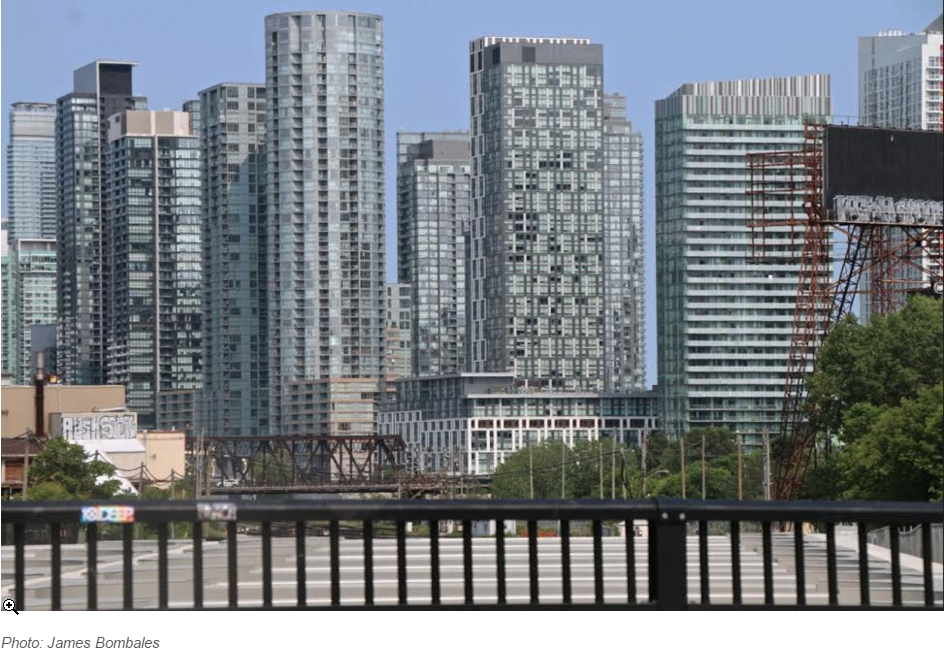

The Toronto condo market is set to level off in the first quarter of 2018, but not before the average downtown price per square foot crosses the $1,000 threshold for

pre-construction units, says Shaun Hildebrand, senior vice-president of real estate market research firm Urbanation.

Unsold condo inventory has already reached an average of $991 per sq. ft. and the average selling price for all new projects that were launched in the City of Toronto in the third quarter was $951 per sq. ft., he said.

“I don’t think it will be long before it averages $1,000 per sq. ft. A couple of projects that have opened in the fourth quarter have prices well above that level,” said Hildebrand on Tuesday.

He cited the launch of The One, the 82-storey Mizrahi development at Yonge and Bloor Sts. where units are selling for nearly $2,000 per sq. ft.

But high square footage sales aren’t limited to pre-construction apartments. There are re-sale buildings along the Bay St. corridor and in the core that are also trading at over $1,000 per sq. ft., he said.

Market activity for new condos in the Toronto region has nevertheless reached an unsustainable pace, said Urbanation’s third-quarter report.

“At current prices, demand will begin to moderate. Higher levels of inventory will emerge and that will help settle the market activity down,” said Hildebrand.

“We’re seeing signals from the re-sale market that prices have already started to flatten out,” he said.

For the first time in more than three years, re-sale apartment prices dropped slightly in the third quarter from the second — from about $650 per sq. ft. to $648 — still 27 per cent higher than a year ago.

The foreign investor tax introduced by the Ontario government in April, 2017 has not impacted the preconstruction market, although it has helped slow re-sale activity, said Hildebrand.

Urbanation research has shown that only about 5 per cent of new condo transactions are overseas buyers.

There is overseas money in the market, but it is being spent by local families or intermediaries who don’t have to pay the tax. Somebody can buy a condo and by the time the sale closes, the buyer’s children can be attending university here or have migrated to the area, making them eligible for a rebate on the new tax.

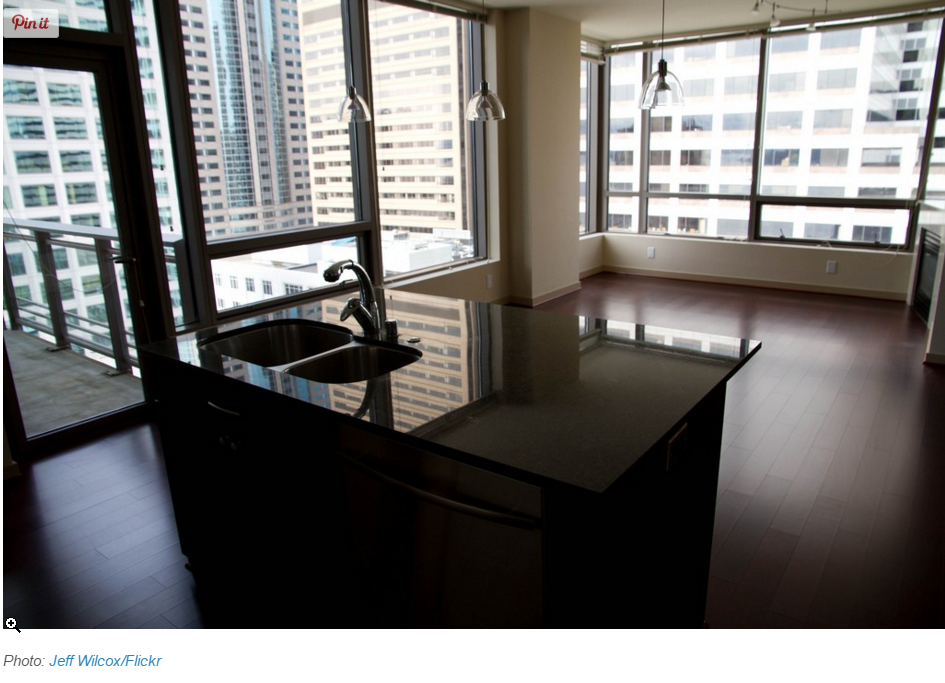

The growth in condo rents (condos represent about 30 per cent of Toronto’s rental stock) is also expected to moderate with about 20,000 new apartments expected to be completed next year.

Expanded rent controls aren’t discouraging condo investment, but the restrictions could prompt investors to sell their units more quickly, said Hildebrand.

The 4,577 new condos sold in the region in the third quarter marked a 30 per cent year-over-year decline with fewer new projects on the market after “an explosive first half,” said the report.

Source: urbanation.ca news

Thinking to sell your house or Condo in Central Toronto areas and/or in downtown Toronto areas? Please call, text or email Max Seal, Broker at 647-294-1177. Please visit http://www.TorontoHomesMax.com for a FREE Home Evaluation“.

Thinking to buy a House or Condo in Central Toronto areas and/or in Downtown Toronto areas? please call or text Max Seal, Broker at 647-294-1177 to buy your dream home or Condo. I offer you a 30-min “FREE buyer’s consultation” with NO obligation.

Please visit my website http://www.centraltorontorealestate.com/ to find out available homes and Condos for sale in Central Toronto areas and/or in downtown Toronto areas.

This Toronto housing market may be a better time for “Move-up”, “Move-down” or “Empty-nester” Sellers and Buyers. Want a “Market Update” of your home in 2018? Please click the image below or call or text Max Seal, Broker at 647-294-1177 or send an email.

Leave a Reply